Vivocom Int’l Holdings Berhad (Bursa Malaysia stock code: 0069) has been stirring up investor interest especially since early-November.

Earlier this month, the company had completed its share consolidation exercise, under which every 10 shares and 10 warrants had been consolidated into one share and one warrant, respectively.

This means that Vivocom’s representation on Bursa Malaysia now comprises 566.45 million shares and 113.29 million warrants.

From a base of 50 sen post-consolidation, the share had been on a progressive uptrend and closed at RM1.50 on Friday, 13 November 2020.

Some industry observers opined that its share price could move even higher.

In an “equity research” report dated 11 November 2020, See Jovin describes Vivocom as a “rare, multibagger investment opportunity in 2020-2021.”

The report said: “History is about to repeat itself as Vivocom is about to embark on a very exciting breakout in its share price. Here’s why:

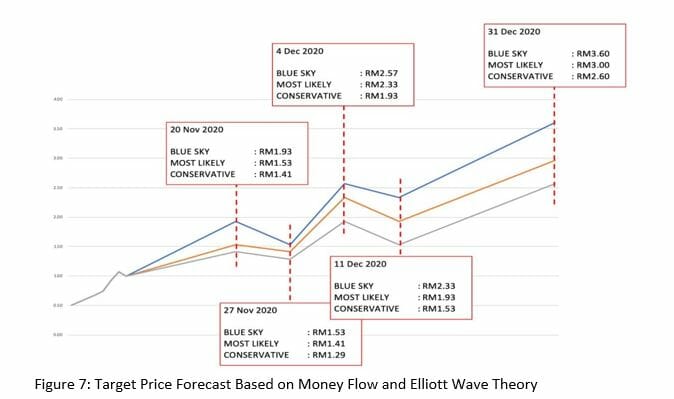

1) The target price of RM3.00 by end December 2020 is derived based on money flow, momentum trading and Elliott Wave theory projection.

2) I believe this will be a genuine and sustainable rally, unlike other stocks whereby their momentum peters out after a couple of days.

3) This stock has tremendous followings based on the number of buyers, buyers’ quantities and massive liquidity from the past 6 months of trading.

More extracts of the report as follows: A whooping grand total of 950 million shares have been traded in the span of 10 days. In other words, an average of 95.0 million shares per day have changed hands. This is 499% higher than its 3-month average daily traded volume of 15.86 million shares per day.

Vivocom’s value transacted amounted to total of RM756 million in the past 10 days, averaging RM75.6 million per day. This is 461% higher than its 3-month average daily traded value of RM13.49 million per day.

Vivocom was also third most traded in terms of value on 4th and 6th November respectively, trailing behind only Top Glove and Supermax, two of KLSE’s darling heavy weights.

The exceptional liquidity of Vivocom’s shares, as seen from its high volume and value traded as well as a tight price spread is a rare phenomenon for small-mid cap stocks, as this kind of liquidity is usually seen in large cap stocks only. It is beloved by investors as it means investors can enter and exit at any given point in time without any difficulty.

The buy rate is consistently higher than 50%, with the past 10 days average at 54.7%, showing that there are more buyers than sellers in the market. “

The report does have a disclaimer worth noting: “This report has been prepared by See Jovin. See Jovin does not have any business with the company covered in this research report but owns shares of the company. As such, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. See Jovin is not recommending neither a buy nor sell call. This report is purely prepared for educational purposes only.”

A copy of the report can be found here.